The 8 Best Budget Apps for 2022

Table of Content

We recommend the best products through an independent review process, and advertisers do not influence our picks. We may receive compensation if you visit partners we recommend. Information about Honeydue has been collected independently by CNBC and has not been reviewed or provided by Honeydue prior to publication. Information about PocketGuard has been collected independently by Select and has not been reviewed or provided by PocketGuard prior to publication. Information about You Need a Budget has been collected independently by CNBC and has not been reviewed or provided by YNAB prior to publication. Information about Mint has been collected independently by CNBC and has not been reviewed or provided by Mint prior to publication.

Prior experience includes news and copy editing for several Southern California newspapers, including the Los Angeles Times. She earned a bachelor’s degree in journalism and mass communications from the University of Iowa. The top apps are based on ratings on app platforms and popularity among users. Plum links to your current account and can give you daily notifications of how much money is in there. However, this is great for letting you know if somebody has unexpectedly dipped into your bank. Any money you have in your Tandem account earns a rather decent 1.35% .

Simplifi by Quicken

While many of the apps on this list focus on the United States, Money Dashboard caters to the United Kingdom. Money Dashboard bills itself as the United Kingdom’s best financial services app and many users compare it to Mint. Simplifi by Quicken offers the best, freshest, most understandable user experience, incorporating state-of-the-art interfaces with can't-miss navigation tools. NerdWallet blends editorial content with a credit score, plus limited income- and expense-tracking tools.

To help users trek up that learning curve, YNAB’s website offers many educational resources describing exactly how to budget and use the app. It is a parental control app and ensures the safety of the kid. It is very easy to install and come at a reasonable rate ($9.99/month). One of the most simple, intuitive, and convenient family budget app with interactive dashboards. This advice is general and has not taken into account your objectives, financial situation, or needs.

Our pick for most people: Simplifi by Quicken

You can breakdown into categories where your money is being spent or which merchants you use the most. Then take a look at this comparison of the best budgeting and personal finance apps for UK customers to see which one is right for you. Collect all of your bank and credit card statements over the past year.

We chose You Need a Budget as the best overall option because it offers the best combination of flexibility and features, making it more than worth its monthly price. It guides you through making an intentional, forward-thinking plan for your spending. Plus, its goal tracking and reporting features help you monitor your progress.

Should I pay for a budgeting app?

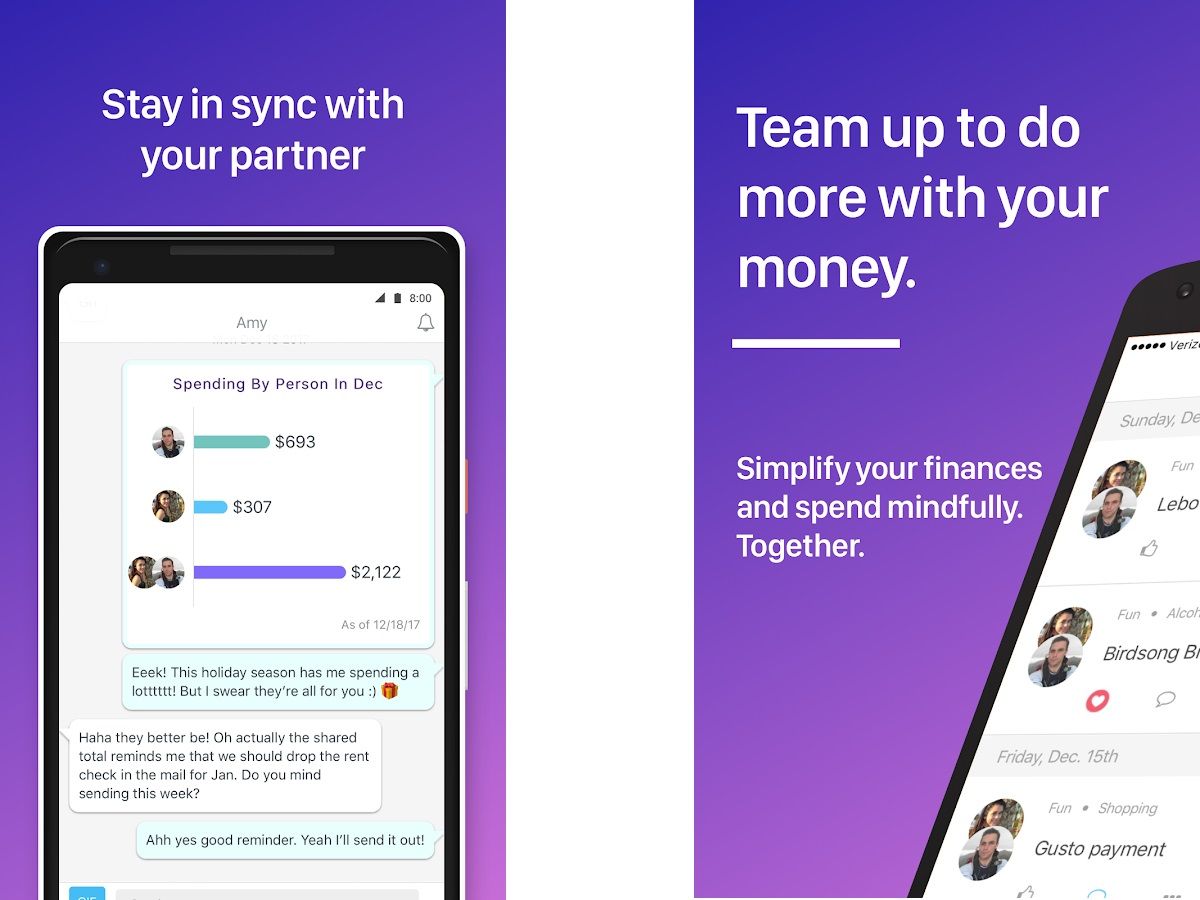

And algorithms in the program that help you identify and cancel unwanted subscriptions can help college students identify opportunities to keep more money in their pockets. We chose PocketGuard as the best option for college students because it makes it easy for busy students to see at a glance how much money they have available to spend. Its goal tracking features and intuitive pie chart help even beginning budgeters see if they're on track. And most of its features are free, which is ideal for those on a student budget. The account has free ATM access, a debit card for both partners and no monthly fees or minimums. That's why there are so many budgeting apps designed to do the grunt work for you — and some of them actually work perfectly for couples.

If money is taken from your account due to a security issue or privacy breach related to a third-party app of this kind, your bank may hold you responsible for issues such as fraud. Financial protections and safeguards you may have otherwise received as a customer may be impacted based on the terms and conditions of agreements with relevant providers. It’s also worth checking what budgeting features are offered by your bank or financial institution.

YNAB, for hands-on zero-based budgeting

Creating a budget can help you organize your finances, which can improve your finances. Using a budgeting app is one way to create and stick to a budget. Kate's work has appeared in outlets like Business Insider, Financial Planning magazine, MagnifyMoney, Credit Karma, and Simple Money magazine. She received her Certificate in Financial Planning from Belmont University.

There’s also an option to create a savings envelope, where funds roll in each month toward a larger financial goal. The paid version of EveryDollar is a part of Ramsey+, a personal finance membership. It’s a one-stop, all-access subscription that gives people an easy-to-follow personalized plan for their money. Ramsey+ includes the FinancialPeace, EveryDollar, and BabySteps apps, so members can learn, budget, and track their money goals. And it’s also full of other resources, tools, and content to help people on their financial journeys. Mint is an affordable and highly flexible budgeting app that allows users to track and categorize transactions based on repeated or one-off spending.

So we read reviews of the apps in the iOS App Store and Google Play, noting complaints and kudos. We only included apps that received at least 4.5 stars in the iOS App Store or at least 3.5 out of 5 on Google Play, as well as at least 1,000 reviews. In Fudget’s ultra-simple design, you make lists of incoming and outgoing money and track your balances. The Pro account allows you to also export your budget, along with other extras. With all this decision making, YNAB is about as hands-on as you can get.

Contact the product issuer directly for a copy of the PDS, TMD and other documentation. Buddy is free to download, but you have to pay a subscription to unlock full functionality of the app. Raiz is free to download, but there are fees when you start investing. For Standard portfolios, it is currently $3.50 per month for accounts under $15,000, or 0.275% per year for accounts $15,000 and over. For an iOS app to make our list, it had to have 35,000 or more reviews and a rating of 4.5 or better. On Google Play, an Android app needed 100,000 or more reviews with a rating of 4.5 or greater.

Comments

Post a Comment